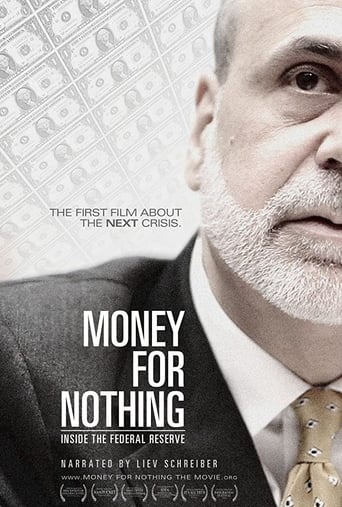

Money for Nothing: Inside the Federal Reserve (2013)

Nearly 100 years after its creation, the power of the U.S. Federal Reserve has never been greater. Markets and governments around the world hold their breath in anticipation of the Fed Chairman's every word. Yet the average person knows very little about the most powerful - and least understood - financial institution on earth. Narrated by Liev Schreiber, Money For Nothing is the first film to take viewers inside the Fed and reveal the impact of Fed policies - past, present, and future - on our lives. Join current and former Fed officials as they debate the critics, and each other, about the decisions that helped lead the global financial system to the brink of collapse in 2008. And why we might be headed there again.

Watch Trailer

Free Trial Channels

Cast

Similar titles

Reviews

I wanted to like it more than I actually did... But much of the humor totally escaped me and I walked out only mildly impressed.

This is a must-see and one of the best documentaries - and films - of this year.

The movie turns out to be a little better than the average. Starting from a romantic formula often seen in the cinema, it ends in the most predictable (and somewhat bland) way.

There is, somehow, an interesting story here, as well as some good acting. There are also some good scenes

This film is an obvious attempt to create the illusion that the Fed is sorry for their mistakes, but they will do better in the future. I will return my DVD to the sell-out director today. The Fed is the crux of our debt, corruption and war and this film paints them as a team of financial gods who made some mistakes, but should remain in control of our monetary system. The Federal Reserve is private group of con-artist bankers and was CREATED to monopolize the monetary system of our once great country. Shame on YOU for creating this film. I suggest reading Creature from Jekyll Island to understand the background of the greatest scam ever perpetrated on the American people and the world.

The movie ends by suggesting that the latest bubble was essentially caused by an 'Asset Inflation' due to the fact that apparently the US Federal Reserve no longer takes into account housing or essentially fuel prices!? What, that is obviously false... Check the US Bureau of Labor Statistics and you will see that both are definitely in there.I would agree that they have changed the way that some items have been covered, namely the housing prices which are now calculated as basically the rental equivalent of each home owners home instead of the housing price. Though, that is common among the OECD nations just like Canada and a few others. Check the US Consumer Price Index website and you will see. Also check this link, which explains some of the misconceptions out in the general public: http://www.bls.gov/cpi/cpiqa.htm As for the rest of the movie, well it hammers away at your intelligence with misinformation and jarring commentary. The movie was partly informative for creating an interesting story of Volcker, Greenespan and whatever the liar in charge of the Fed is called. Still too many logical fallacies and misrepresentations using often false information. I would give this more than 2 thumbs down if I could.

A gem in the movie industry, conveying the federal reserve as pacifist who hates the idea of forcing people to come to grips with reality. Conveying the federal reserve as having foresight all the time,even though there is some denial of this near the end. The very pacifist mentality was the ideal of the federal reserve to act as a cushion to protect the delusions of the public rather than act as moralist dictator. So the federal reserve allowed investment out self interest that had no direct long term benefit to society this was more acceptable than forcing a moralist view on the economy. One of the prime reasons the fed always acted as a cushion rather than a moralist was the monetary gain, which were only asset inflation and this was the delusion of the people. Against there better judgement they obeyed the people's will in general. The asset inflation is inflation mistaken as monetary gain, however when ever individuals profit by inflation inequity rules as they got the money for free or nearly free. For the investors get rich, those who own stock and houses and so on, and everyone else suffers poverty. No one wishes to change this as that would create the appearance of monetary redistribution. Worse yet because the market gains where an illusion, there are no new jobs for the youth as there shall always be to many people and not enough jobs, as industry is very efficient in the new computer robotic global economy.Hence everyone must work less hours so everyone can work otherwise pay for a welfare state which has negative effects in itself, for if neither of these are done The People shall and will starve to death as there is lots of food and shelter, but no self dependence everyone is dependent upon jobs to get those things, as in past the majority had their own land to farm upon and now they do not. To any length the problem can never be solved by the monetary federal reserve. It was never their fault in the first place. Blaming a bunch of pacifist who would do anything to ensure the economy kept going given the conditions of a computer robotic global economy is a sad lie. These federal reserve people call it the free market but what they are meaning is forcefulness is rape, they simply hate pushing their morals upon a people who do not want them, people wanted free money and so they got what they desired. The sacrifices we must make to remain a compassionate society is something that is going to be token by force. Plainly none of us are honest enough to admit we have stolen from ourselves a fair and equitable society. Where money is earned by giving to society a long lasting benefit in service, rather than just profiting our selves, I can say being a pacifist myself, I have lost everything by a forceful economy that was self serving and now I have profited being self serving. If someone takes by force what I have token without any benefit to society, at least I can say its fair enough to me.

A must-see film for investors looking to understand the recent Boom & Bust cycles produced by the Federal Reserve. More importantly, a must-see film for investors looking to dodge the next BIG bubble. The producer does an excellent job illustrating the history of the Federal Reserve and its original role in the economy. Most impressive, is the quality of the cast interviewed during the film. Members of the Federal Reserve, IMF, Bank of International Settlements, and famous economists to name only a few examples. The credibility of these individuals gives the information more weight than the average documentary. Finally, the film goes on to explain how the Federal Reserve has become something that was not originally intended during its creation, a political instrument that impacts every one of us. Never has it been more important to understand this concept and how it applies to the next big bubble being created as we speak.